Singapore’s MSME policy is not just about writing cheques; it’s a whole‑of‑government design that removes friction, reduces risk, and builds competitive capabilities. Four pillars stand out: digital adoption, enterprise capability development, access to finance, and pro‑business regulation.

Digital adoption is driven by IMDA’s SMEs Go Digital programme, which publishes industry playbooks and maintains a catalogue of pre‑approved solutions under the Productivity Solutions Grant (PSG). Complementary tools—Start Digital starter packs and CTO‑as‑a‑Service—lower the effort of choosing and sequencing the right tech stack. The emphasis is pragmatism: pick proven tools that fit local compliance, then scale.

Enterprise capability development is anchored by the Enterprise Development Grant (EDG). Rather than subsidising generic spend, EDG backs defined projects with measurable outcomes. That structure nudges firms to articulate strategy, redesign processes, and invest in innovation with a clear line of sight to productivity or revenue gains. For firms aiming abroad, the Market Readiness Assistance (MRA) grant supports “learn fast” internationalisation by funding activities like market research, business matching, and trade fair participation.

Access to finance arrives through the Enterprise Financing Scheme (EFS), a risk‑sharing framework delivered via participating banks. By absorbing a material portion of default risk, the government catalyses lending for working capital, trade, fixed assets, projects, and venture debt. The policy logic: keep credit flowing to viable SMEs through economic cycles, without distorting lending decisions or bypassing private‑sector underwriting.

Pro‑business regulation and navigation complete the picture. The Pro‑Enterprise Panel (PEP) invites businesses to flag rules that unintentionally raise costs, enabling adjustments or sandboxes. SME Centres provide no‑cost advisory, while GoBusiness and GovAssist consolidate scheme discovery and licensing. On the talent and skills front, SkillsFuture subsidies and the SkillsFuture Enterprise Credit (SFEC) align workforce upskilling with enterprise transformation. IPOS adds support on intellectual property strategy and protection, helping MSMEs convert know‑how into assets.

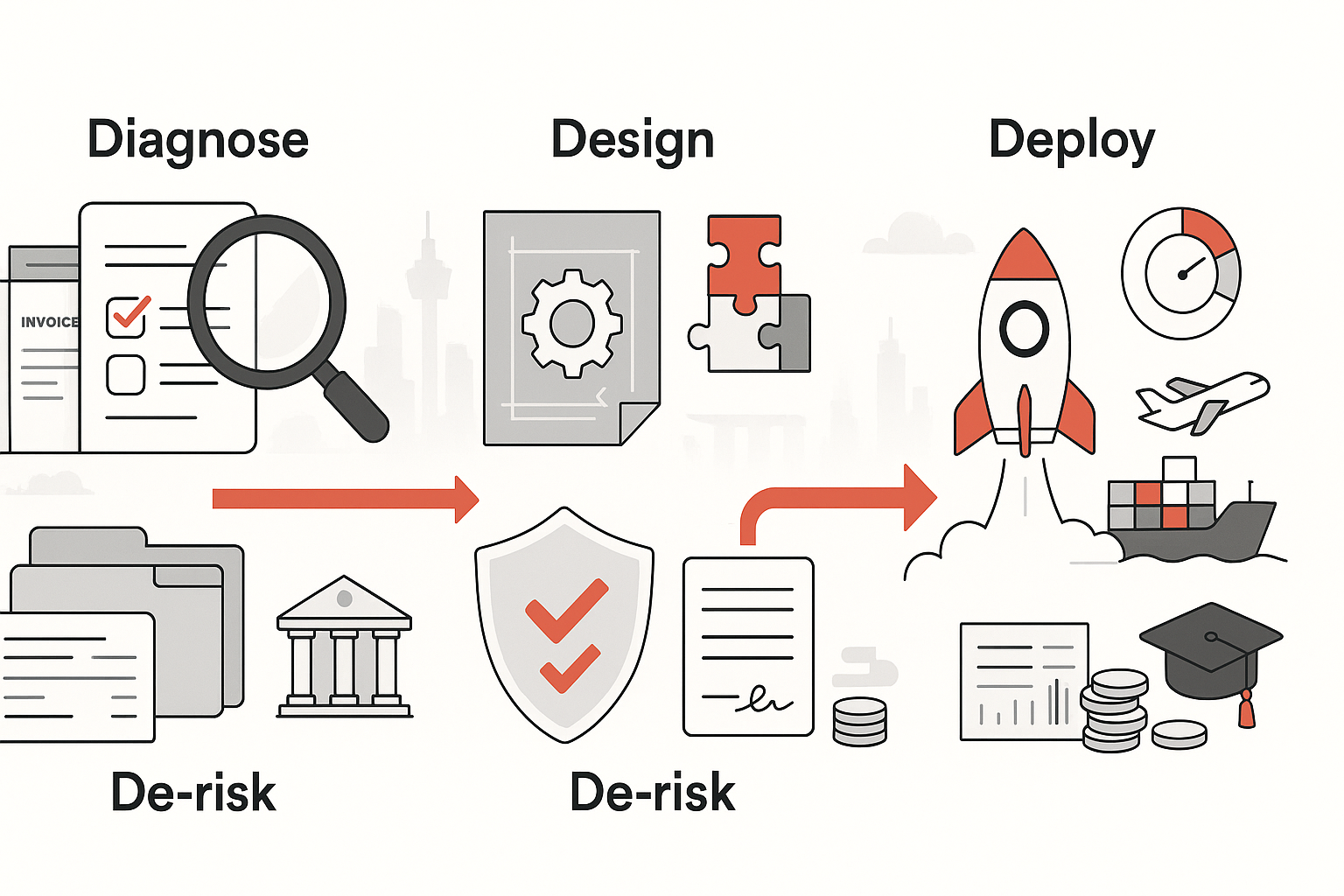

Taken together, these pillars form a predictable pathway: digitise, professionalise, finance, and scale. Execution still rests with the firm—sound governance, robust financials, and a compelling value proposition—but the public scaffolding reduces friction and shares risk in targeted ways. To get the most from it, treat grants and loans as accelerants tied to a roadmap, not as ends in themselves. Build a simple metric tree (cycle time, defect rate, gross margin, export revenue) and choose programmes that move those needles.

Practical note: eligibility typically includes being registered and operating in Singapore, having meaningful local shareholding, and meeting SME thresholds for group revenue or employment. Schemes evolve in scope and support levels over time; check current details with EnterpriseSG, IMDA, and participating financial institutions before committing spend.